Work with CareFirst Administrators

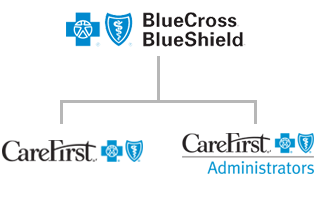

CareFirst, CFA and BCBSA

Think of BCBSA as an umbrella. It is the national partnership between all Blue Cross Blue Shield insurance entities. In most cases, if our members need treatment outside of their in-network provider service area, BCBSA allows access to coverage through its broad BlueCard PPO network.

Regionally, CareFirst’s BlueChoice network is the regional HMO network covering Maryland, Washington D.C. and parts of northern Virginia, with a strong overlap with the BlueCard network. Many of our local providers are part of the BlueChoice HMO network and the PPO network for maximum patient access. As a subsidiary of CareFirst, the regional and national networks are both available to CareFirst Administrators members. Below we’ll explain the differences between the two.

CareFirst is a traditional health insurance carrier. In this model, the insurer (CareFirst) largely predetermines the different health programs available for clients to select on behalf of their employees. Companies that adopt carriers tend to accept what is available in the marketplace. Employees will opt-in or opt-out of the benefits in their company’s chosen package(s). The utilization management and care management metrics and guidelines are set by the carrier, and members are enrolled in the carrier’s care management programs as specified by the carrier.

CFA is a subsidiary third-party administrator (TPA) of CareFirst. TPAs are organizations that process insurance claims/benefits for a separate organization. Whereas an insurance company normally takes on the risk on behalf of the client (employer), in a TPA model, the employer itself takes on the financial risk. Employers that choose CFA do so for benefits including:

- Faster claims processing

- Superior customer service support

- Flexible and customizable plans

- Paying claims only as they’re incurred

- The ability to set their own limits, using other vendors for utilization management, care management and covered benefits