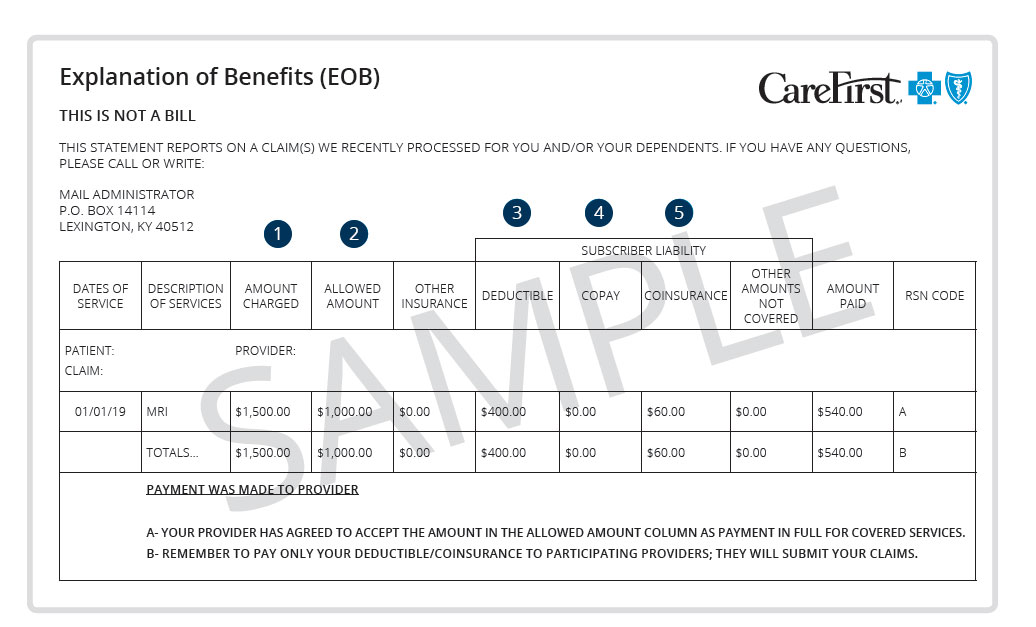

Explanation of Benefits

After you begin using your plan benefits, CareFirst will provide you with an Explanation of Benefits (EOB) by mail or email notification. An EOB summarizes your medical care and the costs associated with the care you received. An EOB is not a bill but will detail costs you may be responsible for under “Subscriber Liability.”

1

Amount charged—The amount billed by your healthcare provider(s) for your visit(s).

2

Allowed amount— Also called the allowed benefit, this is the highest amount in-network providers are allowed to charge for covered services, regardless of their actual charge. So, if the doctor’s visit is $200 and the allowed amount is $100, that’s all you’ll have to pay; even less if you only owe a copay or if you’ve met your deductible. If a provider you use is not part of your plan’s network, that provider can charge more than the allowed amount, and you may have to pay the difference.

3

Deductible—The set dollar amount that you pay out-of-pocket every plan year before CareFirst begins to pay its portion of your claims. Your actual deductible depends on the health plan you choose. Premiums and copays do not count toward your deductible. Certain services may not require you to meet your deductible first such as services that have a copay or preventive care.

4

Copay— The fixed amount (for example, $30) you owe for certain covered healthcare services like doctor office visits.

5

Coinsurance— The percentage owed for certain covered services. Once you have met your deductible, you pay a certain percentage and your medical plan pays the rest.