CareFirst Merger Update

Backround

On November 20, 2001, CareFirst BlueCross BlueShield and WellPoint Health Networks signed an agreement under which WellPoint would acquire CareFirst for $1.3 billion. The proceeds from the sale would be shared by the three primary jurisdictions - Washington, D.C., Maryland, and Delaware - in which CareFirst does business. Before the conversion to for-profit status and acquisition by WellPoint can move forward, it must be approved by insurance commissioners in all three jurisdictions. In addition, approval from the U.S. Congress is required to meet certain conditions governing changes to CareFirst's D.C. affiliate. |

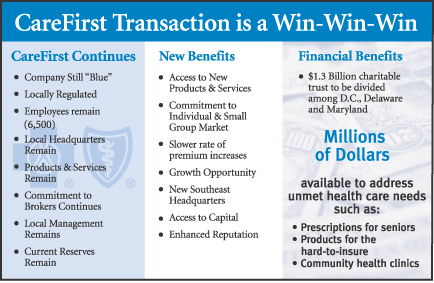

Representatives of CareFirst have been working closely with insurance regulators, participating in formal hearings and public forums, and meeting with members and interested groups throughout the region. In every venue, CareFirst has emphasized the clear and compelling benefits of the merger and conversion.

CareFirst Continues

The attributes that our members like about CareFirst - locally delivered, high-quality products and services - will continue and be enhanced. WellPoint, like CareFirst, is a member of the Blue Cross Blue Shield family and our agreement preserves Blues headquarters in D.C., MD and DE and our members will continue to be served by local CareFirst associates.

CareFirst Will Serve You Better

By joining with WellPoint, CareFirst will have access to new resources to create products to better serve members, customers and health care providers. We will be able to invest in technology that will save members time and make CareFirst more efficient. And, the savings and efficiencies gained as part of a large, national company will help us slow the rate of premium increases.

The Community Benefits

The merger will generate $1.3 billion that can be used to do immense good in D.C., MD and DE. If used to establish charitable trusts in each jurisdiction, the money will generate more than $100 million annually to fund health care programs and meet the needs of the uninsured and underinsured.

The regulatory review process is now well underway. Insurance commissioners in each jurisdiction have engaged or will soon engage a number of outside financial and health care experts. These experts will provide independent analyses of matters related to the process through which CareFirst reached its decision to be acquired by WellPoint, the impact on health care in the region, and whether the $1.3 billion purchase price is appropriate.

In Maryland, a series of community forums and public hearings were held this past winter and spring and more will be held this fall. Public forums were held in D.C. in March and public hearings are scheduled for early December. Similar forums and hearings are anticipated in Delaware.

About The Agreement

Why did CareFirst agree to merge with a company headquartered outside the Mid-Atlantic region?

WellPoint is one of the most respected health care companies in the nation. The company is known nationally for providing value to its members and shares our commitment to the "Blues" brand. In fact, the company already operates Blues plans in California, Georgia and Missouri. WellPoint is a strong company with a belief in and commitment to local decision-making. The combination of these factors makes WellPoint an ideal fit with CareFirst.

How was the purchase price of $1.3 billion reached?

As in any bidding process, the price is established by what a buyer is willing to pay. Both WellPoint and Trigon offered $1.3 billion for CareFirst. WellPoint's offer was considered superior for a variety of reasons: its commitment to local executive leadership; its willingness to maintain local Blues plan headquarters in D.C., Maryland and Delaware; and its plan to make Maryland the headquarters for a new WellPoint Southeast region. In considering WellPoint's bid, CareFirst relied on the advice of its financial consultant, Credit Suisse First Boston (CSFB). CSFB performed a valuation of CareFirst in March 2001 and the $1.3 billion purchase price was well within the valuation range.

What will happen if regulators determine that $1.3 billion isn't fair value for CareFirst?

We believe the price is fair and appropriate. Both CareFirst and WellPoint used respected investment banking firms as part of the negotiations that led to the agreement of a fair purchase price. A change in price would represent a significant change to the deal negotiated by CareFirst and WellPoint.WellPoint Chairman Leonard Schaeffer has indicated that such a change would require re-examination of the agreement.

Who decides where the funds will go from this transaction?

The $1.3 billion will be shared among the primary jurisdictions in which CareFirst does business - D.C., Maryland and Delaware. The division of the $1.3 billion among the jurisdictions and its specific uses will be determined by the respective regulators and elected officials.

Transaction Offers Many Benefits

The conversion of CareFirst to for-profit status and subsequent merger with WellPoint - which, like CareFirst, is part of the "Blues" system - will preserve what is best about the company and produce an array of tangible benefits for members and the communities we serve. |